Ed Lee touted San Francisco’s down payment assistance program in his State of the City address this week. How well does it really work in an incredibly expensive real estate market like San Francisco?

- Assume a couple with no kids is making 120% of the median income, which is the maximum you can make to take advantage of this program.  That is $93,250 for two people.

- Monthly that works out to $7,771 per month. Let’s go over to bankrate.com and see what they can afford to buy.

- Let’s assume they can max out the down payment assistance at $200,000 and plug that in as the down payment.

- I assumed no other debts. This is pretty unlikely as most people have a car payment, credit card bill or a student a loan (or all three).

- I made assumptions about rates (4%), taxes ($7,000/yr) and homeowners insurance ($1200/yr) that may or not be perfect but are close enough.

- You can buy a $ 642,773.13 home (in this very simplified calculation).Â

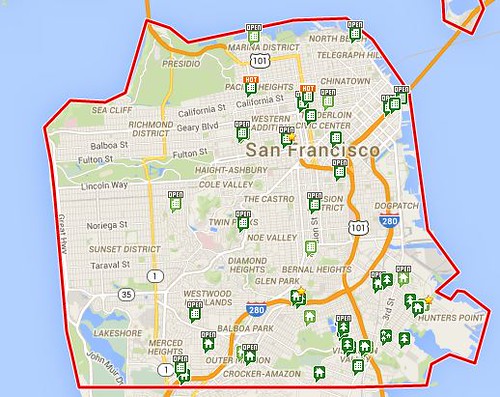

How many properties are there in this category? Redfin shows 49. Many are either TICs studio units (good luck getting your financing to work out on that if you are trying to get financial assistance from the city) or vacant land. There are admittedly a few actual homes for that price, but it’s slim pickings.

What are the other catches to this program?

- You must be a first time home buyer.

- There is a minimum of 1 person for bedroom, so if I couple can only find a 3 bedroom house that meets their criteria they are out of luck.

- The buyer must contribute 5% of their own funds to the purchase price ($32,000 for the example above)

- The buyer must have three months of reserve funds after purchasing.

There are also other problems- it is very difficult to get a mortgage on a property that is considered a “fixer” in San Francisco (which many of the properties in this price range are) and your offer will not be very competitive on a property with multiple bids. That other couple that isn’t getting down payment assistance will most likely be able to offer more money.

This doesn’t seem like a realistic solution to help solve a housing crisis in its current state, but perhaps part of the program to offer more funding could also change the terms?